® "MUNICIPAL SOLUTIONS" IS A REGISTERED TRADEMARK | © 2023 PRIVACY & USE POLICY

FOLLOW US

® "Municipal Solutions" is a registered trademark in the US and in several states. Use without express permission is prohibited by law.w.

®

EFFICIENCY STUDIES & OPERATIONS AUDITS

How can elected officials and public administrators improve economic and financial certainty, reduce risks while developing a highly-efficient organization?

$47,109,000 in uncollected driving license fees

$2,000,000 in unaccounted for utility customers

$1,053,000 unpaid Franchise Fee liquidated damages

$650,000 in uncollected debt from delinquent utility bills

$600,000 in underperforming software inefficiencies

$600,000 in underpaid Franchises Fees

$500,000 in Uncollected Revenue from bad water meters

$450,000 in Overstaffing

$429,000 in overpayment of Software Licenses& fees

$400,000 saved through consolidation

$240,000 in excess Fleet Management expenses

$101,000 in reductions of pay periods from 52 to 26

$50,000 in elimination of bi-annual elections

$29,600 per vehicle through fleet conversion to bio-diesel

Over the past 20 years, our consultants have advised more than 400 local governments, 12 national ministries, 50 provincial governments and 14,000 civil servants. In all, we've helped these public institutions discover more than $500,000,000 in uncollected revenue, inefficiencies and recommended spending reductions through comprehensive Organizational Assessments, Compensation Studies, Process Re-engineering, Forensic Audits and Policy changes.

Because of these methods, public administrators throughout the world have realized greater revenue through lower taxes and fees, improved efficiency and reduced risk while providing citizens with better access to public services.

Results

Clients & Consultant Experience

Arlington County, VA

Cuyahoga Counnty, OH

City of Arkansas City, KS

City of Fort Collins, CO

City of Boston, MA

City of Walker, MI

City of Billings, MT

City of Lewistown, MT

City of Concord, NH

City of Hanover, NH

City of Cincinatti, OH

City of Beachwood, OH

City of Daytona Beach, FL

City of Delray Beach, FL

City of Parkland, FL

City of Coconut Creek, FL

City of St. Cloud, FL

State of Missouri DPS

State of Utah DPS

Gov't of Egypt -MSMEDA

Martin County, FL

Palm Beach Co. Water Utility, FL

City of Fort Worth, TX

City of Frisco, TX

City of Beaumont, TX

City of Bellville, TX

City of Houston, TX

City of Port Arthur, TX

City of Avondale, AZ

City of Flagstaff, AZ

City of Glendale, AZ

City of Goodyear, AZ

City of Sunnyvale, CA

City of La Habra Heights, CA

City of Burbank, CA

City of Inglewood, CA

City of Kent, WA

State of Arizona - ICT

Kabul Municipality, Afghanistan

Union of Myanmar

Reduce your Risk for Financial Loss

Results

Results

All public agencies face significant risk associated with one or more of the following issues:

People, Planning, Policies, Processes, Procedures, and Paperwork.

Operational, Performance, and Forensic Audits are necessary to identify waste and fraud to attain efficiency and innovation within your organization while minimizing the negative impacts that revenue reduction can have on service quality. These risks compound in the absence of trained experts who identify and remedy these issues, risks and liabilities.

Comprehensive Operations Efficiency Audits can empower decision-makers and provide the following potential benefits:

• Elimination of Waste

• Validation of Best Practices

• Reduction of Fraud & Legal Risk

• Discovery of Uncollected Revenues

• Efficient Asset Management

• Reduction and Reallocation of Personnel

• Efficient Technology Integration & Planning

• Reduction of expenditures

• Identify public-private partnerships

• Privatization / Consolidation alternatives

• Maximize your agency’s revenues

A Revenue & Expenditure Analysis can be highly productive and result in identification of over or

over-utilized revenue streams. It can also identify the availability, feasibility & implementation aspects

of grants and other alternative financial resources needed for both current and future programs.

A Revenue and Expenditure Analysis carefully examines:

Increase your agency's Revenues

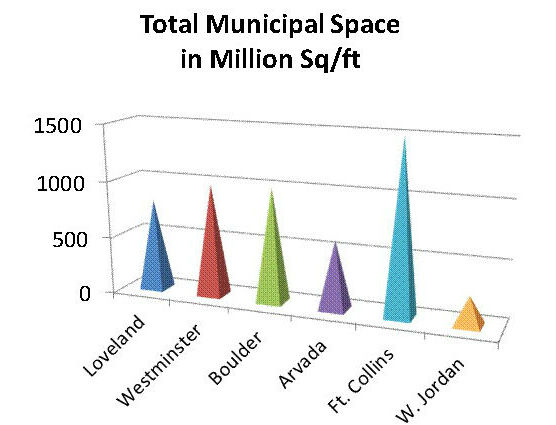

Ratio of Streets Personnel to Lane Miles Maintained Cutodial Service Benchmarking

• Alternative funding strategies

- Consolidation vs. Privatization

- User Fees vs. Taxes

- privatization & competition

• Cost center comparative analysis

• Development Agreements

• Franchise Audits & Non-compliance

• Fleet Management

• Fuel Consumption / Alternatives

• Grant Funding options

• Impact / User Fee Analysis

• Legal taxing / funding alternatives

• Procurement Standards & Limits

• Mutual-aid Agreements

Password: