® "MUNICIPAL SOLUTIONS" IS A REGISTERED TRADEMARK | © 2023 PRIVACY & USE POLICY

FOLLOW US

® "Municipal Solutions" is a registered trademark in the US and in several states. Use without express permission is prohibited by law.w.

GOVERNMENT EFFICIENCY

ASSESSMENTS, AUDITS & IMPLEMENTATION

Organizational Efficiency & Change

Understanding the6 Ps

All public agencies face significant risk associated with one or more of the "P-Issues":

People, Planning, Policies, Processes, Procedures, and Paperwork.

Operational, Performance, and Forensic Audits are necessary to identify waste and fraud to attain efficiency and innovation within your organization while minimizing the negative impacts that revenue reduction can have on service quality. These risks compound in the absence of trained experts who identify and remedy these issues, risks and liabilities. Comprehensive Operations Efficiency Audits can empower decision-makers and provide the following potential benefits:

• Elimination of Waste

• Validation of Best Practices

• Reduction of Fraud & Legal Risk

• Discovery of Uncollected Revenues

• Efficient Asset Management

• Reduction and Reallocation of Personnel

• Efficient Technology Integration & Planning

• Reduction of expenditures

• Identify public-private partnerships

• Privatization / Consolidation alternatives

• Maximize your agency’s revenues

Our team of experts would be happy to discuss your situatuation.

Increase Revenues

A Revenue & Expenditure Analysis can be highly productive and result in identification of over or over-utilized revenue streams. It can also identify the availability, feasibility and implementation aspects of grants and other alternative financial resources needed for both current and future programs.

A Revenue and Expenditure Analysis carefully examines:

• Alternative funding strategies

- Consolidation vs. Privatization

- User Fees vs. Taxes

- privatization & competition

• Cost center comparative analysis

• Development Agreements

• Franchise Audits & Non-compliance

• Fleet Management

• Fuel Consumption / Alternatives

• Grant Funding options

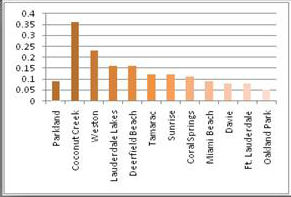

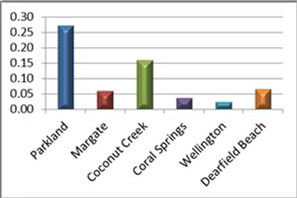

• Impact / User Fee Analysis

• Legal taxing / funding alternatives

• Procurement Standards & Limits

• Mutual-aid Agreements

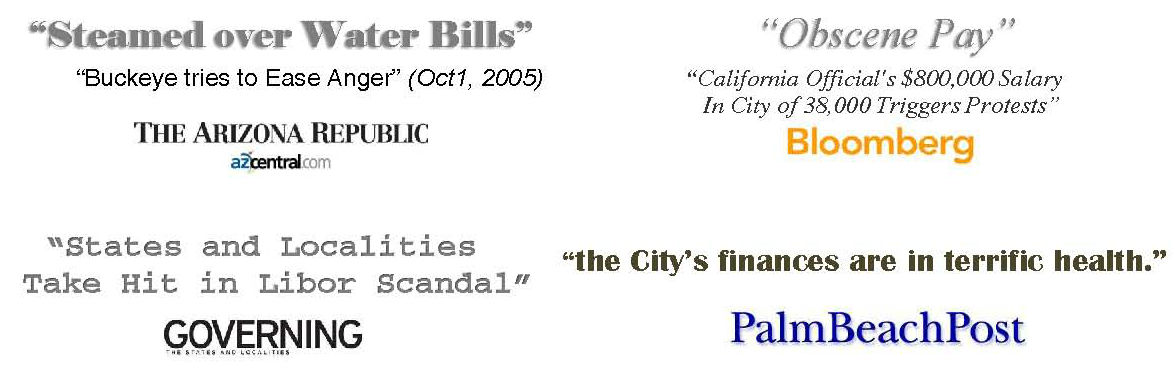

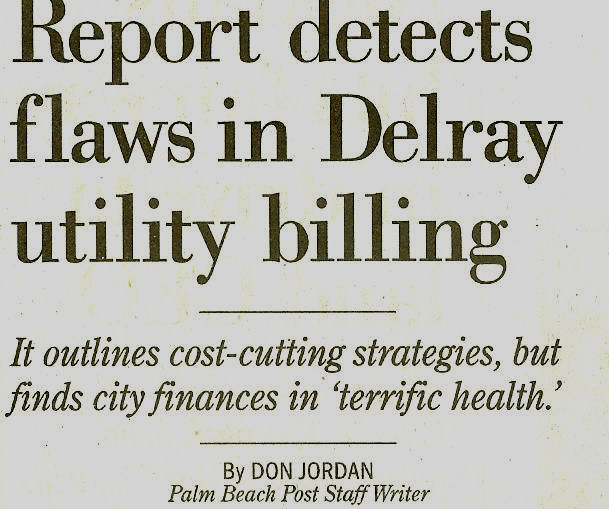

Avoid negative attention for your community

Public servants deserve good press! Most City Managers, Elected Officials and Department Heads work diligently to serve the public and delivery quality pubic services. Our consultants understand the need to help find greater efficiencies without the ‘drama’ or ‘scandal’.

Improve Performance of Public Servants

Our Performance Audits can include a comprehensive examination of one individual department or multiple departments which perform related tasks and functions. Our experience conducting Individual Department Audits includes reviews of:

Peace of Mind for your Community

Effective and efficient local government managers view services through the lens of four groups: residents, local businesses, employees & elected officials. When we identify and respond to the changing needs of your dynamic community, the most important obligation of a public administrator is fulfilled.

Identifying the most desired services can assure the highest quality in service delivery and can assure peace of mind, economic prosperity, and quality of life.

Every government agency faces two realities: risk and the opportunity for greater efficiency. Our consultants have empowered many teams to achieve results, discovering $340,000,000 in revenue and savings.

How can you face political and economic uncertainty and achieve comfort, safety and security?

Over the past 10 years, our consultants have advised over 435 large and small Local Governments, 50 Provincial Governments and more than 14,000 Civil Servants in 60 countries. We have helped public these agencies discover more than $521,109,000 in uncollected revenue, inefficiencies and spending reductions through Forensic Audits, Comprehensive Organizational Assessments, Compensation Studies, Organizational Realignments, Process Re-Engineering, Policy Manual revisions and effective implementation. Because of our methods, public administrators have realized greater revenue collections, improved efficiency, reduced fraud and better public access to public services.

Results:

• $47,109,000 in uncollected driving license fees

• $2,000,000 in unaccounted for utility customers

• $1,053,000 unpaid Franchise Fee liquidated damages

• $650,000 in uncollected debt from delinquent utility bills

• $600,000 in underperforming software inefficiencies

• $600,000 in underpaid Franchises Fees

• $500,000 in Uncollected Revenue from bad water meters

• $450,000 in Overstaffing

• $429,000 in overpayment of Software Licenses& fees

• $400,000 saved through consolidation

• $240,000 in excess Fleet Management expenses

• $101,000 in reductions of pay periods from 52 to 26

• $50,000 in elimination of bi-annual elections

• $29,600 per vehicle through fleet conversion to bio-diesel

and gas-electric hybrids.

9-11

Dispatch

Accounting / Finance

Airports

Administration

Ambulance

Development Services

City Clerk’s Office

Cemeteries

Fire Department

Fleet Management

Facilities Maintenance

Golf Courses

Human Resources

Legal Services

Library Services

Parks Maintenance

Marinas

Public Health

Information Technology

Planning Services

Public Information

Public Safety / Police

Public Transportation

Public Works

Recreation Services

Risk Management

Street Construction

Street Maintenance

Stormwater

Water & Wastewater

Traffic Safety

Urban Planning

Zoo

With our Cross-departmental Audits, we examine the critical relationships which exist between departments which (if unaddressed) keep your organization from delivering the services your residents expect.

Accounting & Budgeting

Business Processes & Procedures

Procurement & Purchasing

Customer Service

Consolidation & Privatization

IT Hardware & Software

Collections & Delinquencies

Development & Franchise Agreements

Organizational Structure

Records Retention / Storage

Legal Compliance

Litigation Analysis

Risk Management Analysis

Operational Policies

Staffing Skills & Staffing Levels

Password: